Découvrez nos ressources

Profitez d’un accès illimité à des articles de qualité sur les dernières tendances en éducation et en entreprise.

Participez à des programmes de formation

Mettez à jour vos compétences et améliorez votre expertise grâce à nos formations pratiques et interactives.

Rejoignez notre communauté

Obtenez des conseils d’experts et échangez avec d’autres professionnels passionnés par le développement en entreprise.

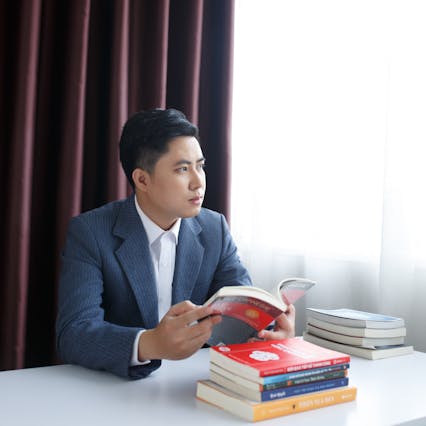

Découvrez Qui Nous Sommes

Éducation Expert est votre destination de prédilection pour tout ce qui concerne l’entreprise et le développement professionnel.

Nourrissez votre esprit avec notre contenu exclusif sur l’actualité, la formation et le développement professionnel.

Renouveler vos connaissances

Approfondissez et élargissez vos compétences grâce à notre contenu éducatif à jour.

Faire des choix éclairés

Nous fournissons des ressources claires et fiables pour vous aider à prendre des décisions avisées en matière de développement professionnel.

Explorez nos ressources

Articles spécialisés

Nos articles couvrent une variété de sujets pertinents pour les professionnels et les entreprises, allant de l’actualité à la formation en passant par les stratégies de marketing et bien plus encore.

Développement de carrière

Découvrez nos programmes de formation approfondis conçus pour stimuler votre croissance professionnelle et vous aider à atteindre vos objectifs professionnels.

Nous proposons une variété unique de services pour vous aider à atteindre vos objectifs.

Grâce à nos formations de haute qualité et à notre expertise en marketing, gestion et autres domaines clés, vous ferez la différence dans votre secteur.

Formations engageantes

Découvrez nos formations interactives conçues pour développer vos compétences et vos connaissances en entreprise.

Stratégies de marketing éprouvées

Réalisez votre potentiel avec nos techniques de marketing éprouvées pour promouvoir votre entreprise et augmenter votre visibilité.

Expertise en gestion

Améliorez vos performances en tant que responsable en utilisant nos ressources spécialisées en matière de gestion et de leadership.

Consultation personnalisée

Notre équipe de professionnels vous fournira des conseils personnalisés pour vous aider à réussir dans votre domaine.

Donnez le pouvoir aux professionnels et aux organisations pour prospérer.

Prêt à passer à l’action et à faire évoluer votre carrière et votre entreprise ?

Chiffres clés

Découvrez notre impact et notre expertise en développement professionnel.

Actu

250K

Business

500K

Formation

1M

Marketing

750K

Les marques qui nous font confiance

Donnez le pouvoir aux professionnels et aux organisations pour prospérer.

Prêt à passer à l’action et à faire évoluer votre carrière et votre entreprise ?

Articles récents

Restez à jour sur les dernières actualités et tendances de l’industrie grâce à notre blog d’entreprise.

Guide Ultime : Élaborer une Stratégie de Marketing de Marque Gagnante

Comprendre l’importance d’une stratégie de marketing de marque Une stratégie de marketing de marque réussie[…]

L’Impact Crucial de la Psychologie du Travail sur le Leadership Efficace

Les Principes Clés de la Psychologie du Travail La psychologie du travail joue un rôle[…]

Maîtrise des Risques Environnementaux dans l’Industrie Chimique : Techniques Incontournables et Innovantes

Techniques incontournables pour la gestion des risques environnementaux dans l’industrie chimique La gestion des risques[…]